Taxatation and Development

Author: Sana Banyal

Symbiosis Law School, NOIDA

ISSN: 2582-3655

Abstract

The performance of a country is marked by the rate and growth of its GDP. The calculation of the helps one estimates the expenditure or income received based on the manufacture of products. The value of the GDP helps measure the economic activities of a country over some time.[1] In the field of taxation, the Indian economy, like many other prominent nations, is going through a revolutionary change. Every government’s primary source of income is through the means of taxes which are collected from the general public; this is also an essential step of the economic developmental processes across the globe. The collection of taxes directly establishes the price of goods and services in the market, which indirectly affects the purchasing power of the consumers. For long-term development and economic growth, the correct use of the tool, taxation must be done by the government. Through this research project, we would be analyzing the impact of the application of a variety of Taxes in India on the economic development of the nation.

Introduction

The most basic source of income for the government of every country and state is through the implementation of taxes. These taxes are used by the government to provide the general public with facilities that improve their livelihood and help the country achieve a more significant financial result. The process of collection of taxes follows the principle of ‘Quid Pro Quo’ which means something in exchange for something.[2] The revenue so accumulated by the government is therefore used for the benefit of the general public. It is of vital importance to understand how to use the tools of taxation, as they are essential for determining the stage boom or depression in the economy of a country. Therefore, a balance must be achieved while dealing with this economic tool.[3]

There are different types of taxation mechanisms used all over the world, in India, a combination of the progressive and proportional systems of taxation have been used over a long period. Under the Indian tax jurisprudence, slab-wise taxability is followed whereas, proportional tax is applicable for alternative taxes like – excise duty, VAT, service tax and wealth tax.[4]

The progressive taxing system allows the government to collect different taxes set at a different level as per the level of income an individual owns.[5] Therefore, the number of tax increases for every person as per the rise in their income. Other than this, the proportional taxing system involves the collection of fixed tax rates from all individuals and does not vary as per their annual income. In today’s time to monitor the taxation system has become quintessential to look into the financial challenges in forms of fiscal deficits of the country. Over the past few years, the government of India has taken steps to reduce the fiscal deficit of the country. They have through the FRBM Bill, refrained the government from making any future borrowings from the RBI, which positively reduced the deficit by 2% of the GDP.[6]

Historical background of taxation in India

· Pre-independence taxations laws in the country

During the 1850s, i.e. pre-independence stage of India was the time when the Britisher’s first introduced the concept of taxation in the country due to the constant revenue difficulties faced by the Colonial Government.[7] The tax was initially introduced for a 5-year period, which was later replaced by a license tax applicable to trade professions. During the following few years, the tax system was further changed to be known as the ‘certificate tax’. This form of the tax system was abolished by the government in the year 1873. The further developments which took place in the field of taxation have been mentioned chronologically below: –

- : This Act imposed taxes on the financial gain of both the residents and non- residents of the country. The Act further exempted all financial gains received from the agricultural avenue because the land revenues were subject to direct taxes.[8]

- :The Act of 1918 brought under its receipts casual and non-recurring nature, concerning business and professions. Some specific provisions were added in the 1918 Act for the primary concern of business for computing business deductions for computing net. The Act of 1918 remained valid for a brief period but was replaced by a brand-new Act (Act XI of 1922) given the reforms introduced by the government of India Act, 1919.[9]

- : it was during 1922 that the mechanism of administering taxes and the rates at such taxes are to be levied was set. This procedure brought the much-needed flexibility in adjusting the tax rates with the annual fund necessities.[10]

- : The Act of 1961, is subject to constant time amendments by the Annual Finance Act and different legislation concerning tax. The 1922 Act was replaced with this Act on the 1st April 1961 and had been smoothly processing for the past 40-years. This revenue enhancement was declared to be applicable for the fiscal year 2007-08 (i.e. the assessment year 2008-09).[11]

The objective of taxation in a developing economy, India

Taxation can affect the development of a developing economy in a variety of ways. Some of the most prominent and primary objectives that taxation has in a country have been listed below –

· Objective – Economic Development

The economic development of any country is one of its primary objectives. Here the economic tool of taxation plays an essential role in achieving the same. The process of capital formation of any country is termed as its economic development. However, sometimes the collection of funds falls short of what is expected.[12] To fill up these deficiencies and to continuously mobilize the funds within the country uses the mode of taxation to get it done. Taxes help one generate more revenue with the government, which helps develop new infrastructure in the country and improve the standard of living of the people.[13]

However, precautions must be taken by all authorities regarding the investments of a nation, because if the resources of investment are only circulated in the country only to develop the unproductive sectors, then it would lead to creating a disbalance between the development of the country. Thus, a correct balance for the holistic development of the country must be done.[14]

· Objective -Full Employment

The second objective of a developing nation would be providing the general public with more employment options. As taxes are inversely proportional to the demand for employment, the lower the tax rates would maximize the employment opportunities for individuals. This would ensure the rise in the income of people and services, providing more satisfaction.[15] This would in-turn increase the purchasing power of the consumer and lead to more sales and purchase of goods. Thus, increasing the GDP of the country.[16]

· Objective Price Stability

Thirdly, the short-term object of taxation is maintaining price stability in the market space of a country. One of the biggest concerns of inflation in a country can be reduced by carefully regulating Taxes.[17] The control over the direct taxes will ensure control over the private spending of individuals. The indirect taxes as are applied only on goods/ product in the market it can be a significant factor which fuels inflation in a country.[18] Therefore, the government and leading economists must look at the overall development and requirement of the country and its people before they take any step further.[19]

· Objective – Control of Cyclical Fluctuations

Fourthly, taxation may help every government control the period of boom and depression in a country, i.e. the cyclical fluctuation. During the phase of depression, the government reduces the taxes to increase the purchase and sale by the people whereas, during the boom, the taxes are increased to reduce the purchasing power of people and encourage them to purchase and sell less.[20]

· Objective- Reduction of BOP Difficulties

Fifthly, the implementation of taxes in a country can also help one manage the imports and exports of commodities. The increase in the taxes for the import of goods can be done to positively encourage and motivate the consumers to buy products from the Indian market place or the domestic market.[21]

Impact of taxation on the economy

· The impact of direct taxes on the economic growth of the country

The essential form of revenue for the government is the ‘direct tax’. The direct tax also represents the income readily available with the individuals for disposal. The effects of increasing the direct tax would increase the saving of funds by the public and indirectly will also increase the amounts of investments made by these people. This attitude of the individuals eventually hampers the economic growth of the country. This would intron lead to the drastic decrease in the demand for luxurious products and therefore reduce their production, leading to a catastrophic fall in the country’s GDP and economic health.[22]

Nevertheless, if a positive approach is considered and deductions are encouraged on investments, it will lead to an increase in the capital formation of the country. The following are the benefits of direct taxes on the economic growth of the country – leads to better capital formation, encourages more saving and investment, Surety of Government’s revenue growth, increases the planned expenditure of the government and Timely availability of revenue to the government.

· The impact of indirect taxes on the economic growth of the country

The liability to pay the indirect tax is directly upon the consumers. Therefore, indirect taxes directly related to the price of goods & services.[23] Thus, it is the producers who deal more with this particular tax as it either ensures their increase in demands and also pushes the producers to adopt cost-cutting measures. Further, this effort of producers additionally brings the correct utilization of resources within the economy. The consumers here are at the freedom to choose the product of their choice and thus, a healthy competition grows within the economy. Further, are some of the benefits of Indirect taxes which have been listed below – higher utilization of resources, Increase in the potency of producers, additional freedom of option to the shoppers.[24]

The positive expectations from the new budget 2020

On the 1st February 2020, the country’s Finance Minister, Ms Nirmala Sitharaman realized the new budget for the year 2020-21 which is likely to implement the following changes in the taxation systems within the country:

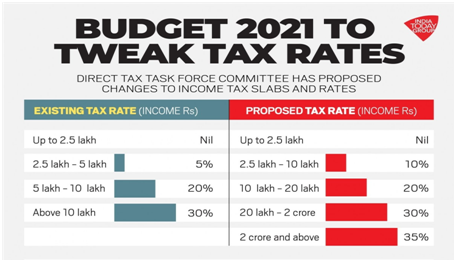

- :In the current scenario where the growth of the economy is seeing a slow rise in the government has decided to announce four-different tax slabs in order to increase the disposable income for the individuals.[25] The change is significant for those individuals who are earning between 2.5 lakh to Rs 10 lakh. There has been a change in the slab rate which now exists at 20 per cent slab for an income between Rs 10 lakh to Rs 20 lakh followed by 30 per cent for the income between 20 lakhs to Rs 2 crore.[26]

- :Last year the budget of 2018, led to the increase in the deduction limit from 40,000 – 50,000. In the current budget, this rate has been increased further to 80, 000/-. The standard deduction for the salaried taxpayers was re-summarized at 40,000/- and removal of 15, 000 was done for the medical reimbursement.[27]

- The government has decided to get rid of levying taxes on notional financial gain received from unsold houses and houses, not let-out. The separate category of self-occupied homes norm could also be far away from the present law.[28] Money received from house property would be solely attributable to the contractual rent or the lettable value of the house given out on rent.[29]

Fig. 2[30]

- In this year’s budget, the government may announce an amendment in the tax-free dividend profit, Dividend Distribution Tax (DDT).[31] The search for new ways and methods is on by the stock market of India, which is now focusing on the investors.[32] The government seemingly proposed that rather than the corporate firms, shareholders will be paying taxes on dividend gain from now on. Currently, corporations pay the education cess at 3 percent and the DDT at 15 percent of the dividend along with the 12 percent surcharge.[33]

Fig. 3[34]

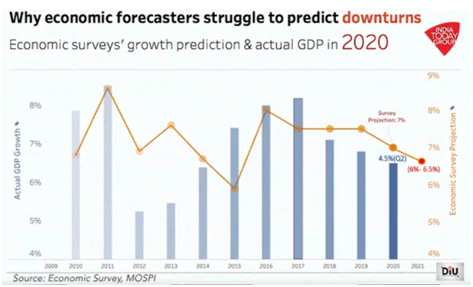

Currently, the Indian economy is facing a downfall after the steady rise in the year 2017. The revised GDP figure before the release of this year’s budget showed a further downfall from 6.8 percent to 6.1 percent. As per economic scholars, it is speculated that the estimated real GDP rate by the end of the financial year 2020 will increase by 5 percent.[35]Concerning the economic survey of 2020, it is assumed that the 5 percent GDP will be the lowest rate recorded for 2019-20. The government is hopeful that with the coming budget, the changes will significantly help the general public to boost their disposable income and recuperate the subdued economy.[36]

Conclusion

It can be stated in the conclusion that no state or government can achieve excellency in all the stated objectives of taxation. A too highly Progressive tax system could cause inequalities amongst individuals within the legal system and could also scale back the inequalities at the same time. The most straight forward measure to take would be to adopt a tax system in the country, which helps improve the current situation of the economy and which aims to achieve the required objectives from time to time.[37]

In the opinion of WW Heller, it should be the objective of every nation to achieve optimum use of their resources to grow continuously. Economic policies have played a vital role in the development of many countries and their economies.[38] These instruments include the tool of taxation which has proven to be one of a significant game-changer. The correct measures of capital resources with the correct measures of purchase and sale are the fundamental operations that help the nation achieve economic development. Thus, proper taxation rules, norms, and policies need to be developed by the government to manage the conflicts so faced by the individuals of a state.[39]

[1] Bird, R. M., Review: Tax Reform in India Reviewed Work (s), Interim Report of the Tax Reforms Committee by Raja J. ChelliahTalx Reform in India, Vol. 28 (2018).

[2]Murty, S., Lessons from Optimal Taxation for the GST and Beyond, pp. 24-55 (2017).

[3] Venkataraman, S., &Urmi, A., The impact of taxation on economic growth in India : A disaggregated approach using the ARDL bounds test to co – integration, International Journal of Accounting and Economics Studies, 5(1), 19–21 (2017).

[4] Burgess, R., Stern, N., Burgess, B. R., & Stern, N., Taxation and Development, Journal of Economic Literature, 31(2), 762–830 (2016).

[5] Greiner, A., Progressive Taxation, Public Capital and Endogenous Growth, Public Finance Analysis, 62(3), 353–366. https://doi.org/10.1628/001522106X153419 (2016).

[6] Jones, L. E., Manuelli, R. E., & Rossi, P. E., Optimal Taxation in Models of Endogenous Growth, Journal of Political Economy, 101(3), 485–517 (2016).

[7] Turner, J. V. B. and M., Taxation and Economic Growth in Eighteenth-Century England, The Economic History Review, 43(3), 377–403 (2016).

[8] Krushna, A. V., TAX BUOYANCY OF INDIA : AN EMPIRICAL ANALYSIS, International Journal of Research in Management, Economics & Commerce, 5(12), 46–55 (2015).

[9] Gale, W. G., Effects of Income Tax Changes on Economic Growth, Economic Studies, (September), pp. 1–16 (2014).

[10]Maniquet, M. F. & F., Optimal taxation theory and principles of fairness, Asia-Pacific Journal of Rural Development, 7(2), 59–74 (2014).

[11]Supra note 4.

[12] Barro, R. J., Quarterly, T., & May, N., Economic Growth in a Cross Section of Countries, The Quarterly Journal of Economics, 106(2), 407–443 (2007).

[13] Birk, J. M. & A, Employment and Growth Effects of Tax Reforms, (2004).

[14] RAO, M. G. R. & R. K., Trends and Issues in Tax Policy and Reform in India, (1991).

[15]Karran, T., The Determinants of Taxation in Britain : An Empirical Test, Journal of Public Policy, 5(3), 365–386 (1985).

[16] Tyagi B.P., Public Finance, Jai Prakash Nath Publications, Merut (U.P.) Page, 491 (2008).

[17]Walliman N., Your Research Project, SAGE Publications India Pvt. Ltd. New Delhi, pp. 178 (2011).

[18]Sury M.M., Taxation in India 1925 to 2007: History policies trends and outlook, New century publication, New Delhi, India (2008).

[19] Suresh M. And Khan N.A., Trends and Tax Buoyancy in Corporation Tax in Pre and post Liberalization periods in India, IUP Journal of public Finance vol. IX no. 2 , 2011, pp. 45-59 (2011).

[20] Singhania V.K. &Signhania M., Taxmann students guide to income tax incu. CST, Taxmann publication (p) Ltd. New Delhi. p. 779 to 781 (2005).

[21]Supra note 16

[22]ShomeParthasarthi, On the Elasticity of Developing Country Tax system, Article for Economic and political weekly pp.1750-1754 (1988).

[23] Id.

[24]Samal K.C., Tax structure and Budgetary Trends, Manak Publications Pvt. Ltd. Jaipur, Delhi, p. 63-64 (1988).

[25] Sarkar Sandip, Corporate Income and Incidence of corporate Taxation, Article for Economic and political weekly (EPW) 22 Feb. pp.413-416 (1997).

[26] Seligman E.R.A., Essays in Taxation, Macmillan Publications, New York. p. 132 (1925).

[27]Raiyani J.R., Research Methodology Theory and Techniques, New century publications, New Delhi, pp.164-169 (2012).

[28] Prasad C.S., Economic Laws, Regulations and Procedures in India, New century publications, New Delhi, p. 184 (2011).

[29]Panchamukhi P.R., Tax rate & Tax revenue: A quantitative study, Haranand Publication New Delhi, India (1996).

[30]Id.

[31] Mehrotra & Goyal, Income tax law and practice, Sahitya Bhawan Publications, Agra, p. 13 to 14 (1995).

[32]Supra Note 23

[33] Kaldor Nicholas, Tax Reform in India, The Economic weekly Annual pp. 195-198 (1956).

[34] Government of India, ‘Report of the India Taxation Enquiry Committee (1924) (President: Sir ChartesTodhunter), Ministry of Finance, New Delhi.

[35] Government of India, ‘Report of Taxation Enquiry Commission (1953), (Chairman: Mitthai John), Ministry of Finance, New Delhi.

[36] Deshpande R.V., A study of personal Income Tax structure in India special reference to selected district in India, Unpublished Ph.D. Thesis submitted to university of Dr. Babasaheb Ambedkar Marathwada, Aurangabad, Maharashtra (2012).

[37]Chelliah R.J., Task force recommendation on Direct taxes, Commentary for Economic and political weekly, pp. 4977-4980 (2002).

[38] Chand S.N., Public finance, Atlantic publishers’ distributors p. Ltd, New Delhi. p. 105 (2008).

[39] Adam Smith, The wealth of Nation, The modern Library New York, pp.777-79 (1776).